Don't Make Any Investments Without Reading This First!

Investing? Use These Tips to Keep away from Shedding All of your Profits! Can Become Educated About Investing With These Easy Tips

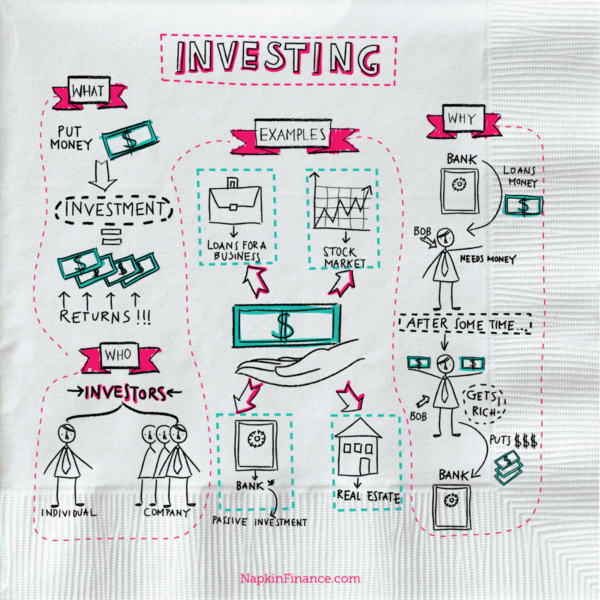

Investments are what a lot of people need to know about, however they do not know where to begin. Here, you'll uncover some nice data to start with. If you wish to study investing, then keep reading the remainder of this text.

Remember that real property investing is all concerning the numbers. When you are shopping for a house to live in, you could get emotional about the place, but there is not any room for that in investing. You want to maintain your eye on the info and make your selections along with your head, not your coronary heart.

Your status is crucial to the success of actual estate investments. You at all times want to maintain an open and sincere relationship with your clients. Once folks know you are trustworthy, they'll be extra prepared to work with you in the future.

Inspections value money. However, if there are Investing Isn't Too Hard To Get Details about with the property that can't be seen by the bare eye, you're prone to spend much more money in the long run. Due to this fact, think of an inspection like an funding and always have one carried out previous to purchasing a property. It may not uncover anything, however there's all the time the chance that there is one thing seriously wrong with a home.

See if there are all of the shops and faculties that you'll need round the actual estate that you're pondering of getting for your loved ones. You don't need to move to an space where you're not close to anyplace that it's essential go to. It might cost you a lot in traveling bills, so keep that in thoughts when you progress anywhere.

Just remember to perform renovations to enhance a property's worth. Remember that good location is a plus in relation to wonderful resale value. Make sure to contemplate the long-time period value of the property when selecting which properties to put money into.

Always ensure that you've got a monetary security blanket whenever you invest. When minor repairs develop into crucial or other bills come up that must do with the rental property, the money you are holding in reserve may be very useful. Another good purpose to put aside some cash is if you can't instantly rent the property. You continue to have costs to think about even if the property is unoccupied.

When assessing actual property for funding, be sure to decide on properties that will pay you a good cash worth on return. Keep in mind that purchasing a property reduces your liquid property briefly. You need to be sure to have the ability to replenish them quickly and amply. Keep in mind that your money was incomes between 4 and 6 p.c curiosity within the financial institution. If you make investments it, it is best to search a higher return.

You will undergo bad and good instances in real property investing. Don't let the lows cause you to give up. It's important to keep it up to realize success. Keep learning new issues and attempting once more and you might be positive to accomplish your goals.

Survey the market often so that you can see when trends are beginnings in order that you will get in on probabilities like that when the opportunity for profit is the most effective. Once you see that there is a demand for a certain kind of property, then you know what forms of properties you may have the very best chance of profiting with.

It's best to take a look at real estate as a protracted-term investment. Whenever you sell, there are selling prices that you are answerable for, such as the commission to your actual property broker. If your funding property did not improve in worth much because you did not hold on to it long enough, it's possible you'll find yourself with a net loss after you factor in paying the fee.

If the realm you might be looking at appears to have numerous vacancies or town seems to be in decline, avoid it. Instead, make investments your cash in real estate located in stable, effectively-established, growing cities. In this fashion you can be certain your investment will continue to develop in worth. Actual property located in a depressed area is sure to cost you money and trigger you complications.

If any contractor you rent to work on a property asks you for an advance for supplies and costs for the job, do not give it to him. He probably has a money circulation drawback and would instead use your funds to complete a venture for someone else, hoping that revenue finishes your job.

If you are a busy particular person, suppose about hiring a property manager. It will value you, however it may also save you a lot of time.

Before you start investing, decide whether or not you're a conservative investor or one who can stomach some threat. Usually talking, the younger you're, the extra funding risk you may assume as a result of you've got extra time to make up for any losses. But if you discover it troublesome to deal with the gyrations of the inventory market, stick with more conservative investments, regardless of your age.

If you're employed and your partner just isn't, you may still open a spousal IRA to your partner. This helps present your partner with a retirement fund that generally is a supply of retirement revenue in later years. Earlier than contributing to a spousal IRA, test the present income limits and deposit limits as these change now and again.

Get to know what Confused About Investing? These tips Will help! 'll be able to about your investments. Investments are more than something to commerce. Whenever you put money into a company, you personal part of that firm. So get to know everything you may in regards to the business. Even if you can't make enterprise decisions, you will know when to buy and sell your stock.

Be Look Right here For Great Advice About Investing for situations to move faster than your thinking. Tons of companies in monetary bother will proceed faster than you can anticipate. Watch out for low cost firms or value traps that produce no or little worth economically. That mentioned, companies that have strong aggressive benefits can often exceed your expectations. Maintain a wide security margin with troubled businesses and a smaller margin with more successful companies.

Do you see how straightforward it is to get started investing? You should be ready to make an preliminary funding based on what you've just read. You now need to leap in and get began. You can't really know if this article has helped you until you check out the information themselves.

UNDER MAINTENANCE